2018 was known as the domestic commercial boom period for NB-IoT. In the past year and a half, the three major domestic operators have basically achieved full coverage of their NB-IoT networks. Additionally, 40% of global operators are actively deploying business applications, with about 5.5 million devices connecting to the Internet of Things daily. American consulting firms predict that by 2021, there will be 28 billion connected devices worldwide, of which 16 billion will be related to the Internet of Things. All of this indicates that the 'Internet of Everything' era is accelerating.

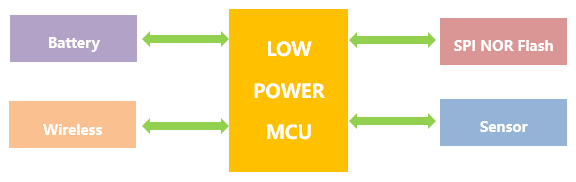

Due to many uncertainties in the Internet of Things (IoT) supply chain, IoT devices are currently mainly developed on MCU platforms to better meet the needs of different application scenarios. The basic components include an MCU, memory, sensors, network modules, and power batteries. With the massive growth of IoT devices, related components also present new opportunities for development, such as NOR Flash memory.

We all know that storage chips are becoming increasingly important in the industry chain, driven by big data, cloud computing, the Internet of Things (IoT), and artificial intelligence. Currently, there are mainly two types: DRAM and FLASH, with FLASH further divided into NOR Flash and NAND Flash. NOR Flash is primarily used for storing code and some data, offering features such as random access, high reliability, fast read speeds, and the ability to execute code, making it the preferred choice for code flash applications in IoT devices.

In fact, the global growth of the Internet of Things (IoT) has given NOR Flash a significant boost. Besides generating substantial application demands, it has also broken the long-standing stagnation in NOR Flash development. This presents an unprecedented opportunity for NOR Flash. However, the diversity of IoT applications also brings new challenges to NOR Flash. In IoT devices, NOR Flash is typically used for MCU data reading and execution, and its process and read speed directly impact MCU performance.

Generally speaking, in the IoT sensing end, low-power and low-voltage MCUs are required. However, as IoT applications expand, MCUs need to support a broader voltage range to enhance product design and development flexibility. For example, in smart home applications, high-current drivers and increased MCU voltage are needed. Additionally, in domestic commercial applications such as remote meter reading, smart water management, smart smoke detection, and automotive systems, there are different requirements for MCU voltage. To meet these needs, manufacturers have introduced more diverse product types. For instance, Texas Instruments' MSP430L092 MCU maintains full functionality within a 0.9V to 1.65V voltage range, supporting comprehensive low-voltage system solutions; Atmel's AVR series and Microchip's PIC series continue to innovate.

On the other hand, while 8-bit MCUs still dominate the market and are widely used in applications like electricity meters, motor controllers, electric toys, variable frequency air conditioners, beepers, fax machines, call identifiers, telephone recorders, keyboards, and USB devices, the decreasing cost of development has led to the widespread adoption of 32-bit MCUs in consumer electronics, communication products, industrial, and medical fields. Especially with the development of IoT, artificial intelligence, and smart cars, 32-bit MCUs have become a significant trend. Consequently, NOR Flash memory and related components need to be updated to meet high-performance and low-power requirements.

It is evident that the diversity and extensive nature of IoT applications further drive the demand for NOR Flash memory, while also imposing higher flexibility requirements on it.

In recent years, significant industry adjustments have been evident in the global memory market. Since 2016, the global storage market has started to recover and reached its peak in 2017, allowing Samsung from South Korea to surpass Intel and rank first globally. This development has also encouraged companies to increase their production capacity investments, coupled with external economic influences, leading the global memory market to enter an adjustment phase after rapid growth. Additionally, the recent Jinwa ban incident has added another variable to the global storage industry.

Firstly, the most noticeable change is the adjustment in memory prices. According to DRAMeXchange data predictions, the average DRAM price is expected to decrease by 15% to 20% in 2019, while NAND flash chip prices are projected to drop by around 25-30%. Specifically, Samsung has postponed its planned new investments for DRAM and NAND Flash in the second half of 2018 until next year, with a significant reduction of 20% in DRAM memory investment. This clearly indicates that the global memory industry is experiencing a cooling trend.

Does this mean there are no more value opportunities in the memory market? In fact, the result is not so. Those familiar with the memory market know that it is a typical cyclical industry, where peaks and troughs always occur together. For domestic enterprises, this is undoubtedly a good opportunity. By continuously improving technology and quality during the industry's adjustment period, they can seize the advantage when the industry recovers. On the other hand, from the perspective of market demand, although the industry is undergoing adjustments, there is still strong demand for NOR Flash in high-end application areas. Moreover, as mentioned earlier, the emergence of new applications such as big data, cloud computing, the Internet of Things, and artificial intelligence provides domestic enterprises with opportunities to quickly capture the market.

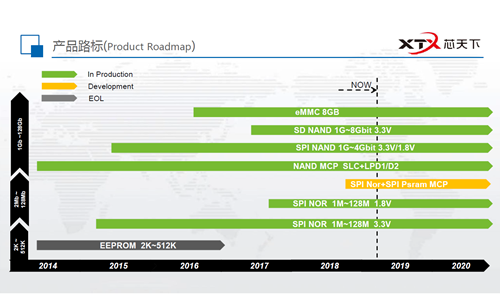

Due to these reasons, domestic companies have remained enthusiastic about investing in the memory sector, such as the main domestic memory supplier, Shenzhen XTX Technology Co., Ltd. (referred to as XTX). Since its establishment in 2014, it has rapidly captured market share by accurately grasping market demand and launching various products including NAND MCP, SPI NAND, SPI NOR, and SD NAND. XTX has become a key practitioner of domestic memory production. With changes in market demand and industrial environment, XTX has continuously improved its product series by increasing investment in R&D and actively expanding business areas. Amidst industrial adjustments, XTX has successfully completed two rounds of financing, which not only represents recognition from capital markets but also reflects the future development potential of the domestic memory industry.

For this purpose, from November 8 to 9, 2018, XTX participated fully in the 'Global CEO Summit' held in Shenzhen. As a specially invited company, XTX also set up an independent booth to showcase its full range of products and share the latest technology roadmap with industry professionals on-site. Additionally, in anticipation of the imminent era of interconnected everything and intelligent technology, XTX has invested significant resources into research and development, and their latest products were all displayed at this event!

Wide voltage range accommodates various application needs

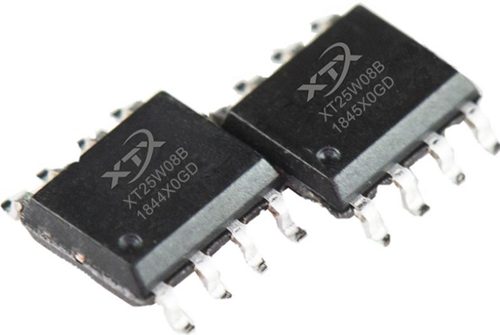

To address the challenges faced by IoT devices and seize opportunities in the IoT industry, XTX has specially launched the Wide Voltage series of SPI NOR flash memory products. According to the specification sheet, their operating voltage range is 1.65 to 3.6V, but they can actually support low voltages down to 1.4V, fully meeting the needs of mainstream market applications and making them an ideal choice for IoT devices.

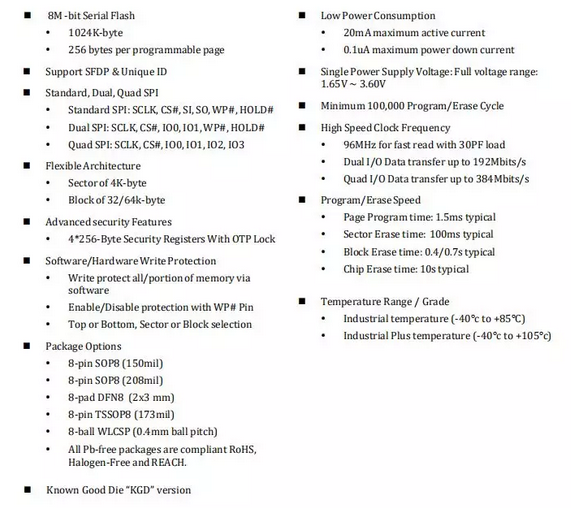

Taking XT25W08B from XTX Technology Co., Ltd. as an example, its features are as follows:

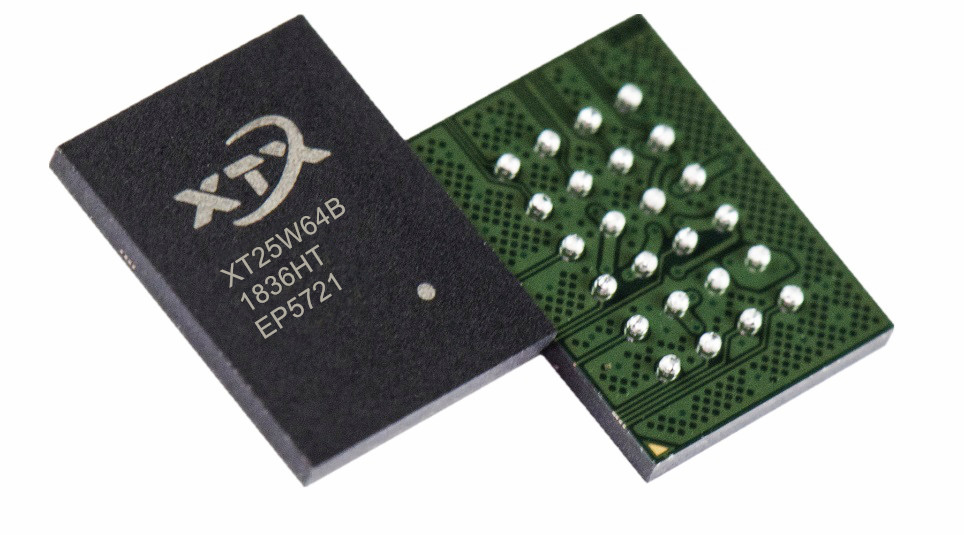

This product features a standard Serial Flash storage design with an 8Mb capacity, supporting the SFDP specification and Unique ID. It consumes 20mA during operation and only 0.1uA in deep sleep mode, covering a voltage range of 1.65V to 3.6V. In addition to its wide voltage support, XT25W08B also offers WLCSP packaging and SiP compatibility, making it easy for customers to quickly design highly competitive products.

Furthermore, XTX Technology offers a series of SPI NOR Flash products that support wide voltage ranges, with specific models listed as follows:

1Mbit Single IO & Dual IO XT25W01D

2Mbit Single IO & Dual IO XT25W02D

4Mbit Single IO & Dual IO & Quad IO XT25W04C

8Mbit Single IO & Dual IO & Quad IO XT25W08B

16Mbit Single IO & Dual IO & Quad IO XT25W16C

32Mbit Single IO & Dual IO & Quad IO XT25W32B

64Mbit Single IO & Dual IO & Quad IO XT25W64B

128Mbit Single IO & Dual IO & Quad IO XT25W128B

XTX wide voltage series products

On the other hand, with the increase in data processing volume on the application side, there is a growing demand for higher capacity SPI NOR Flash products. Currently, the low-capacity market competition is extremely intense, while medium and high-capacity SPI NOR Flash products have greater market value. To this end, XTX Technology is expanding its product voltage range and further increasing product capacity to 128M, with plans to soon launch 256M related products. The manufacturing process will also adopt advanced international 50nm technology to further expand into high-end application markets. In addition to continuously improving the product series, XTX Technology is also constantly upgrading and iterating its technology to meet new market demands.

Low power consumption is a key factor in the Internet of Things.

The large-scale deployment of IoT devices must first consider power consumption, which is also a critical factor limiting the development of IoT. As IoT device performance and integration improve, stricter requirements for power control are imposed. Due to the characteristics of IoT device applications, replacing the battery of a single device would be a significant waste of operational costs. This necessitates that IoT devices have extremely low power consumption and long lifespans.

For IoT devices, extending battery life has become another crucial challenge, requiring comprehensive optimization across all components. For example, XTX's Wide Voltage series SPI NOR memory products support wide voltage ranges and can enter deep sleep mode when not in use, while still being able to respond immediately. Under normal operating conditions, they minimize battery consumption, fully leveraging the potential of MCUs and batteries, reducing IoT device management and maintenance costs, increasing customer commercial profits, and further capturing market share.

With the widespread adoption of wireless networks and the continuous improvement of network access speeds, the Internet of Things (IoT) is leading the fourth industrial revolution. The resulting trillion-dollar market is continuously creating new application scenarios, opening up new market prospects for NOR Flash. Recently, XTX completed a B-round financing of 410 million yuan and plans to focus on IoT applications next.